Waive Penalty Fee - Gst Goi On Twitter Press Release On Waiver Of Late Fee On Filing Of Gstr 3b For August And September 2017 : This means that the money collected or withheld belongs to the state and the debtor is holding the money in trust.

Waive Penalty Fee - Gst Goi On Twitter Press Release On Waiver Of Late Fee On Filing Of Gstr 3b For August And September 2017 : This means that the money collected or withheld belongs to the state and the debtor is holding the money in trust.. Penalties may be waived upon payment of the registration fees due when a transferee (including a dealer) applies for transfer and it is determined that the registration penalties accrued prior to the transferee's date of purchase and the transferee was not aware that the registration fees for the current or prior registration years were unpaid and due (cvc §9562 (a)). To certify that a vehicle with an expired registration was not operated on any public roadway in arizona from the registration expiration date until the date of application for. Letter of waiver of penalty sample. For penalties related to political reform, please email the political reform division. Of course, the best way to avoid irs penalties is to not let them happen in the first place.

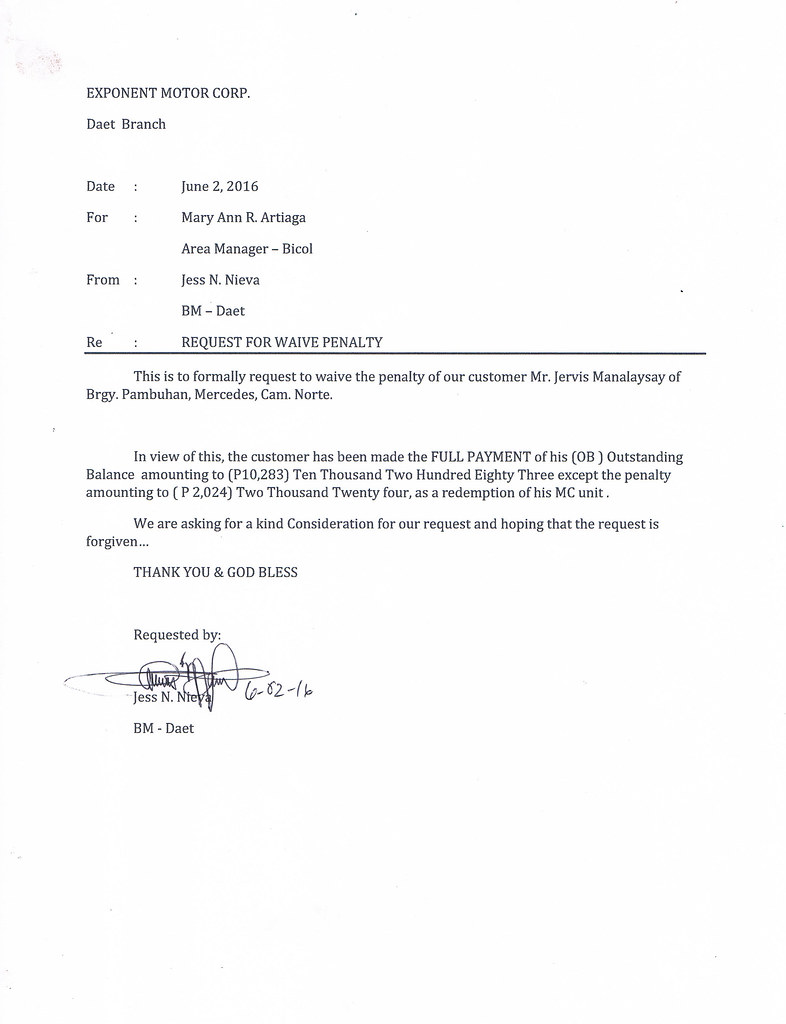

A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The specific dollar amounts are as follows: To waive gst penalty and gst late fee, the cg shall issue a notification by exercising the powers conferred by section 128 of the central goods and services tax act, 2017. The department emphasized there will be no late fees and penalties. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived.

You received a letter or notice in the mail from us with penalties and fees.

In addition, the cares act exempts crds from the 20 percent mandatory withholding that normally applies to certain retirement plan distributions. Penalties may be waived upon payment of the registration fees due when a transferee (including a dealer) applies for transfer and it is determined that the registration penalties accrued prior to the transferee's date of purchase and the transferee was not aware that the registration fees for the current or prior registration years were unpaid and due (cvc §9562 (a)). The waiver request should state the specific reasons for failure to file the statement of information within the required filing period. Business tax and fee division: The penalty is for a late registration. When requesting a penalty waiver for a business, remember that sales tax and withholding are trust fund taxes. Of course, the best way to avoid irs penalties is to not let them happen in the first place. Ca dmv waives late fees, delays registration requirements. The office of the treasurer & tax collector will review your waiver request in accordance with the the san francisco business and tax regulations code (and/or the california revenue & taxation code where applicable) which allow the office to waive or cancel penalties, costs, fees or interest in certain, limited cases. If you can resolve an issue in your notice, a penalty might not be applicable. The coronavirus stimulus package waives 401k early withdrawal penalties, making it easier for americans to access trillions of dollars in retirement accounts to stimulate the economy. It is extremely unlikely you will be able to do this without a visit to the dmv. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

Temporary operating permits that expire. In the event that you file more than 60 days after the deadline, the minimum penalty is either 100% of your outstanding tax balance or a specific dollar amount that is adjusted annually for inflation—whichever is the lesser. The unpaid ohv fees and penalties are the personal debt of the transferor who did not pay the fees and penalties when they became due. To reach another division with the secretary of state's office, please go to the main agency contact information page. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived.

A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

Ca dmv waives late fees, delays registration requirements. For instance, you may be given a citation, a penalty fee, or a new financial obligation. If you received a notice, be sure to check that the information in your notice is correct. The waiver request should state the specific reasons for failure to file the statement of information within the required filing period. When requesting a penalty waiver for a business, remember that sales tax and withholding are trust fund taxes. Temporary operating permits that expire. To whom it may concern, i am writing to ask whether you would consider waiving the late payment charge associated with my most recent electricity bill (dated february 13, 2012) as the postal service lost the check, and ordinarily it would have reached you at least 3 days before. The irs waiver covers taxpayers who underpaid up to 20% of their total tax liability. The department emphasized there will be no late fees and penalties. Rather, it is tacked onto the part b premium and paid for as long as you remain enrolled, causing you to suffer from late fees for many years. Penalties may be waived upon payment of the registration fees due when a transferee (including a dealer) applies for transfer and it is determined that the registration penalties accrued prior to the transferee's date of purchase and the transferee was not aware that the registration fees for the current or prior registration years were unpaid and due (cvc §9562 (a)). For example, let's say you owed $30,000 in taxes. This means that the money collected or withheld belongs to the state and the debtor is holding the money in trust.

As a result of the june 2020 cares act, retirement account holders affected by the coronavirus can access up to $100,000 of their retirement savings as early withdrawal penalty free with an expanded window for paying the income tax they owe on the amounts they withdraw. Of the offices listed below based on the tax or fee program involved. For example, let's say you owed $30,000 in taxes. Visit letters for information about specific notices. But can you get irs fees waived if you didn't have the money to pay your band's taxes?

You're fine as long as you withheld $24,000 or more in taxes throughout the year.

But can you get irs fees waived if you didn't have the money to pay your band's taxes? And if you don't pay the fee if the dmv determines that you owe it, you won't have a valid registration. When requesting a penalty waiver for a business, remember that sales tax and withholding are trust fund taxes. This money cannot be used by a business as additional operating capital or for any other purpose. If you have reasonable cause, we may waive. Business tax and fee division: You're fine as long as you withheld $24,000 or more in taxes throughout the year. As a result of the june 2020 cares act, retirement account holders affected by the coronavirus can access up to $100,000 of their retirement savings as early withdrawal penalty free with an expanded window for paying the income tax they owe on the amounts they withdraw. The unpaid ohv fees and penalties are the personal debt of the transferor who did not pay the fees and penalties when they became due. Vehicle identification number year make plate number owner/lessee name (first, middle, last, suffix) registration expiration date renewal application date The office of the treasurer & tax collector will review your waiver request in accordance with the the san francisco business and tax regulations code (and/or the california revenue & taxation code where applicable) which allow the office to waive or cancel penalties, costs, fees or interest in certain, limited cases. To reach another division with the secretary of state's office, please go to the main agency contact information page. Temporary operating permits that expire.

Komentar

Posting Komentar